What are the Major Types of Trade in the Indian Stock Market?

In essence, a highly liquid stock allows traders to execute trades swiftly and with minimal slippage. You do not have to worry about the connection to the broker or market data, and it has all the features you will need. There are several technical problems with short sales: the broker may not have shares to lend in a specific issue, the broker can call for the return of its shares at any time, and some restrictions are imposed in America by the U. To keep things ordered, most providers split pairs into categories. An uptrend interrupted by a head and shoulders top pattern may experience a trend reversal, resulting in a downtrend. The main disadvantage of options contracts is that they are complex and difficult to price. That’s why it’s best to buy crypto with cash or wire transfers. Install and sign up on the Appreciate mobile app. This means you can go long or short: if you’re bullish, you’d go long; or you’d go short if you’re bearish. Notably, there are many ways in which these aspects of one’s character are exhibited, be it through fear, greed, arrogance and even hope. “Trading in the Zone”, by Mark Douglas is a book well known for trading psychology. Momentum traders typically rely on technical indicators, such as moving averages or relative strength index RSI, to identify overbought or oversold conditions which can indicate potential price reversals. A trading account can hold securities, cash, and other investment vehicles just like any other brokerage account. For this reason, a margin account is only suitable for a sophisticated investor with a thorough understanding of the additional investment risks and requirements of trading on margin. Unlike other strategies, whereby investors may hold on to an asset for several years, swing traders look for brief moments to ride the movements of an asset’s value with minimal downside and optimal upside. Bajaj Financial Securities Limited has actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report: No. It’s time to place orders with your brokerage when you’ve developed a trading plan and researched a range of stocks. I researched their minimum deposits and average balances, and I checked for any ongoing fees. Contrarian investing is a market timing strategy used in all trading time frames.

High frequency trading

When the shorter SMA 10 crosses above the longer SMA 20 a buy signal is generated as this indicates that an upswing is in progress. It wasn’t until I got home that the weight of the loss hit me. HtmlWe believe that an educated investor is a protected investor. Sensibull for Options Trading. This enables the app to provide you with an account that you, the app and, yes, tax authorities can link exclusively and reliably to you. I was hoping that I could get some insight from those of you that are successful swing traders on what strategies/indicators you use. Traders often encounter the double top pattern, popularly known as the M trading pattern, which is a cogent example of symmetric trading patterns. These show when prices are set to change their direction. Here is a list of our partners and here’s how we make money. “The stock market is a device for transferring money from the impatient to the patient. The Product selection https://pocketoption-ar.click/aml-policy/ process and the Testing process. There are four types of forex lots: nano lots are 100 currency units, micro lots are 1,000 units, mini lots are 10,000 units of currency, and standard forex lots are 100,000 units of currency. Therefore, instead of trying to analyze a million economic variables each day this is impossible obviously, although many traders try, you can simply learn to trade price action, because this style of trading allows you to easily analyze and make use of all market variables by simply reading and trading from the P. The aim is to find points where these lines intersect or move above/below each other. Additionally, the book shares a few option trading strategies and also highlights and delves into the importance of risk management. The required capital depends on factors like diversification, risk tolerance, and the markets you trade.

Final Thoughts

In contrast, other over the counter options are written as bilateral, customized contracts between a single buyer and seller, one or both of which may be a dealer or market maker. Check out my full length review of IG to learn more about IG’s suite of mobile apps. You’ll get access to special discounts, exclusive deals, and more, all while enjoying the peace of mind that comes from becoming a member. As I have discussed in this article, certain crypto trading apps are suited for certain requirements. Quant traders are often associated with high frequency trading HFT, a technique that involves using computer programs to open and close a large number of different positions over a short period. The aftermath was tough. Tinker is one of the best option for freshers who entered in Stock Market and Safe Investment. Generate passive income by helpingto secure blockchains. Maximize your profits through Bybit Margin Trading, Leveraged Tokens, and Crypto Loans. Accordingly, any brokerage and investment services provided by Bajaj Financial Securities Limited, including the products and services described herein are not available to or intended for Canadian persons. Similarly, a piece of negative news can cause investment to decrease and lower a currency’s price. As with any other investment strategy, options trading has its lists of potential benefits and risks, and it’s important to understand these to try to avoid making costly mistakes. Another major consideration is how much risk you are willing to incur. For more information, see the developer’s privacy policy. Become a better trader with tastyfx’s free, educational tools, and resources. If you want to buy it, you might have to pay $15. Emotional trading can be influenced by a range of emotions, like panic, greed, excitement, fear and even overconfidence. Each recipient of this report should make such investigation as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document including the merits and risks involved, and should consult his own advisors to determine the merits and risks of such investment. Learn how to form a saving and investing parent/teen partnership early on. The best that do are features below. Range trading requires precise timing, and executing orders inaccurately may result in significant losses. To enter the share market as a trader or an investor, you must open a demat or a brokerage account. It’s crucial for traders to carefully evaluate the risks associated with holding overnight positions and consider these factors in their overall risk management plan. Make sure that you have an emergency fund and that you are adequately funding your savings goals. They could be in great, semi rough, or poor condition—your job is to polish them up and sell them for a profit. A leverage of 10:1 means that to open and maintain a position, the necessary margin required is one tenth of the transaction size. Beginner friendly exchanges like Coinbase and Gemini offer quick buy features that charge higher fees.

Develop your forex knowledge with IG

Morning stock volatility has subsided. Exness SC LTD is a Securities Dealer registered in Seychelles with registration number 8423606 1 and authorized by the Financial Services Authority FSA with license number SD025. During daylight saving DST, which typically starts in March and ends in November, clocks are set forward by one hour. Add to this any commissions and fees and you’ve lost more than the money you put in. Use limited data to select advertising. Your broker would allow you to buy $10,000 worth of stock in the account, and they would charge you an annual interest rate on the margin loan. Get greater control and flexibility for peak performance trading when you’re on the go. Items that are included on the debit side and on the credit side give the resultant figure which is either gross profit or the gross loss. Thanasi Panagiotakopoulos is the founder and president of LifeManaged, a financial planning and wealth management firm in Phoenix now marking its five year anniversary. They use advanced algorithms to analyze market trends and identify profitable trading opportunities. In view of this new process, as specified by the regulatory and the cut off time of Clearing Corporation/Banks processing the funds, Bajaj Financial Securities Limited cannot commit the exact time for releasing funds payout to its client. For example, in the previous case, if the current index value is equal to strike price spot price = strike price, the option is ATM. To navigate the world of option trading successfully, traders often rely on indicators to help them make informed decisions. This means that they can adapt to changing market conditions and make more accurate predictions.

What people on Reddit think

That said, stock prices plunge below the threshold point, which is an indication for individuals to consider short positions or sell shares. Once you understand that this is all a game of probabilities, but outcomes are random, you’ll find that successful trading psychology and mindset is much easier to embrace. Leverage can be another reason to trade with derivatives. You can register and pay it all online these days, all super easy. Leverage and margin are interconnected concepts; they represent the amount of funds needed in your account to initiate a leveraged trade. While success stories of traders earning millions circulate widely, they represent a minuscule fraction of day trading outcomes. The Supreme Court of the United States has ruled that scalping by an investment adviser operates as https://pocketoption-ar.click/ a fraud or deceit upon any client or prospective client and is a violation of the Investment Advisers Act of 1940. Com, and hosts a television show, AnneMarieTV, through StockTwits, LLC. Contact us via chat or E mail. This e mail/ short message service SMS may contain confidential, proprietary or legally privileged information. Please refer the Risk Disclosure Document issued by SEBI and go through the Rights and Obligations and Do’s and Dont’s issued by Stock Exchanges and Depositories before trading on the Stock Exchanges.

11 Momentum Strategy

If we can use our losses to study our game in greater detail and make incremental improvements in our processes, then those losses are no longer threats. CFDs are complex instruments. When you’re new, it’s time to start exploring investments. All leveraged intraday positions will be squared off on the same day. The article was reviewed, fact checked and edited by our editorial staff prior to publication. Nathan Alderman has worked with The Motley Fool since 2005, making errors his arch enemies in a variety of roles including a six year stint as the dedicated fact checker for The Motley Fool’s premium newsletter services. Note that with all trading platforms, there are no guarantees you’ll earn a certain rate of return or current investment options will always be available. Market data is necessary for day traders to be competitive. Take profit could be 2 times the risk or 1:2 risk to reward ratio. Transform your trading journey today. It is formed when a cluster of candlesticks is separated from the rest of the chart by empty space on both sides, looking like an island on the chart. Work out the direct costs of creating your product or service and check what your competitors typically charge. With the help of these tools, you can easily discover the finest opportunities to invest your money. For instance, some traders like to see their gross profit margin without the impact of wages, and therefore will include wages under administrative expenses instead. Any trader who wants to maximise earnings and make educated judgements must understand these market times. Be notified on BTC, ETH, XRP prices, and more. Margin trading, platform lending and advanced trading were not considered for choosing the best crypto exchanges for beginners. Multi broker Connectivity. Electronic trading also poses risks to investors. The distribution of this report in certain jurisdictions may be restricted by law, and persons in whose possession this report comes, should observe, any such restrictions. This chart is useful for traders who are looking for ultra short term investments. The new data feed appears to revert back to the pre October 2009 situation or close to it, with trades “bundled” and allocated to the “aggressor”. Executing trades after confirmation of a W pattern can be effectively visualized through the following table. A slick app can’t make up for the impact of higher than average trading fees and poor execution, for example. Traders can also use slightly more complex multi let strategies known as spreads. You might be using an unsupported or outdated browser. Thats what anne marie baiynd learned when she changed her career from neuroscience researcher to full time momentum trader. This means that currency values are influenced by a variety of international events. Select your country of residency below to see which regulated forex brokers will accept you as a new customer for trading forex. Let’s look at an example of a paper trade.

Supertrend Indicator: What Is It and How It Works?

Let’s look at three of the most commonly used technical indicators for opening a swing trade. A Red Ventures company. Option sellers may own the underlying stock to limit their risk. Access the live market on the go with our Neostox app. “Shoutout to Appreciate’s customer supportteam, they’re seriously amazing. Diversification across different sectors and industries can help mitigate the impact of one or several factors on an investor’s portfolio. Although the golden cross pattern is pretty straight forward, here are a few examples for you to use as a cheat sheet when trading. Profitability in trading depends on market conditions, the trader’s strategy, risk management, and market knowledge. In addition to common tools for researching and trading stocks, Fidelity offers apps and tools to help you reach retirement goals and other long term plans. Bollinger bands: A bit more complex than moving averages, this indicator displays three lines; the moving average, an upper limit, and a lower limit. What is medium term trading and how do you do it. Check out India’s best stock market learning platform to practice virtual trading. Given its reliance on rapid execution, 1 minute scalping is particularly suited to markets with high liquidity and tight spreads, such as major currency pairs in the forex market or large cap stocks. Explore all the features of our platform from advanced indicators to trading alerts. Compare arrows Compare trading platforms head to head.

Centroid Solutions Completes Integration of DXtrade with Centroid Risk Engine

Com, has been investing and trading for over 25 years. We strive to present all the information and pricing as accurately as possible, but we cannot ensure that the data is always up to date. NerdWallet’s ratings are determined by our editorial team. Neostox isn’t just any virtual trading platform—it’s a gateway to mastering the markets. “The app is seriously fantastic. A change in one causes a change in another. NSE National stock exchange is India’s leading and largest stock exchange. Invest An Amount You’re Not Afraid To Lose: Intraday trading is high risk. Traders can gauge the balance between bullish and bearish forces and anticipate potential reversals or continuations. Use limited data to select advertising. If you put up $1,000 and decide to open a leveraged position that is trading 10:1, you can borrow $9,000 from the broker, which means your exposure in the market would be $10,000. Those new to technical analysis may want to check out these books to fine tune their strategies and maximize their odds of success. Why ETRADE is the best for casual traders: What stands out to me about ETRADE apps is, first, how clearly everything is labeled and, second, the responsiveness. You essentially have to have a brokerage account, also known as an investment account, to start investing. Kindle edition: Buy it nowPaperback edition: Buy it now. By practicing with virtual money or in a simulated environment, traders can develop the skills and knowledge needed to make informed decisions and manage emotions and biases effectively. It is a trend following indicator. To Profit and Loss A/c. If any of the conditions are not met, the information must be disclosed as soon as possible this also applies when the circumstances change, for example when the conditions are no longer met. That being the case, it may be that you just want to find a very simple investment app to use for trade execution and use external tools for the investment decision making process.

Overview

Additionally, utilizing services and platforms like TradingView, and attending trading courses are excellent ways to start. Colour Trading App APK is a mobile game that offers a unique and engaging experience, focusing on color prediction challenges and puzzles. With this in mind, Nexo has created an online platform that allows you to earn interest by depositing your digital currencies. Itfunctions as an app for novice investors like me who want to buyUS stocks and ETFs. By the end of this discussion, you’ll feel confident as to which strategy best suits your unique preferences. Go long: Means to buy a financial instrument with the expectation that its price will rise in the future. Screeners is not Exchange approved products and any disputes related to the same will not be dealt on the Exchange platform. The scheme margin is subject to change. Imagine if the ES, trading at 2950. Stock Market Trading Holidays. For example, many bonds are convertible into common stock at the buyer’s option, or may be called bought back at specified prices at the issuer’s option. When share prices rise over the moving average, it is called an uptrend. Options are essentially leveraged instruments in that they allow traders to amplify the potential upside benefit by using smaller amounts than would otherwise be required if trading the underlying asset itself. Crabel has had some influence on technical analysis, and he often suggested that day traders are social psychologists with a computer program. A graduate of Northwestern University’s Medill School of Journalism, Nathan spends his spare time volunteering for civic causes, writing and podcasting for fun, adoring his wife, and wrangling his two very large young children. Global Crypto Exchange, 2023. We researched and reviewed 26 online brokers and trading platforms to find the best companies you see in the list above. Develop and improve services. We are working for fossil freedom. With tastyfx, you’ll trade forex on margin, which means you need a small percentage of the full value of the trade to open and maintain your position. Automated Trading Desk, which was bought by Citigroup in July 2007, has been an active market maker, accounting for about 6% of total volume on both NASDAQ and the New York Stock Exchange. Bear in mind, however, that futures do have a wider spread than spot cash positions. Another option is to go with third party data vendors like Bloomberg and Reuters, which aggregate market data from different exchanges and provide it in a uniform format to end clients. The third classic book by Al Brooks. Regarding eToro investment platform services : eToro EU Ltd.

7 Social Media Agency

For many currencies, the pip is equal to 1/100 of a cent, or 0. It is ideal for budget conscious traders. Another strategy is breakout trading, where traders look for stocks that are breaking out of a defined range and enter trades to take advantage of the momentum. TradeSanta is an automated trading platform that provides a wide range of tools to set up trading bots. Stock options are listed on exchanges like the New York Stock Exchange in the form of a quote. The login credentials have been sent to your e mail. Clients with full options approval and a margin account can apply to trade futures. “Each candlestick is a simple, yet powerful tool to understand what’s happening in the market”. Day trading and swing trading are two different trading styles. I do plan on releasing one. Your broker should be regulated and properly licensed in your country of residence or in a major financial center. Opening Capital Balance. It’s an investment account you can have, just like a Stocks and Shares ISA, or a General Investment Account, where you are free to make any investments you like. Find out more about the advantages of an MTF over a traditional exchange. Investment apps get the job done quickly. Kaysian Gordon, MBA, CFP, CDFA, CPA. It is also known as micro trading. Most investment platforms offer similar benefits. Beginners can use the demo account before getting their feet wet using a live trading account. Store and/or access information on a device. Practice first: It is always a great idea to try out any new trading strategies or learn more about your trading platform in the completely risk free environment of a demo account, also known as paper trading. However, many experienced traders usually choose between first 30 minutes of the market hours, or those looking at higher price movements go for the last 45 minutes and the rest do it in the remaining hours from 10 AM to 2:45 PM. Insider trading happens when a director or employee trades their company’s public stock or other security based on important or “material” information about that business. However, not all traders have to have short term perspectives, and it can pay to learn to trade individual stocks for their long term advantages just like investors do when they hold ETFs. Investing with margin accounts means using leverage, which increases the chance of magnifying an investor’s profits and losses. In some cases, you can do both on the same platform.

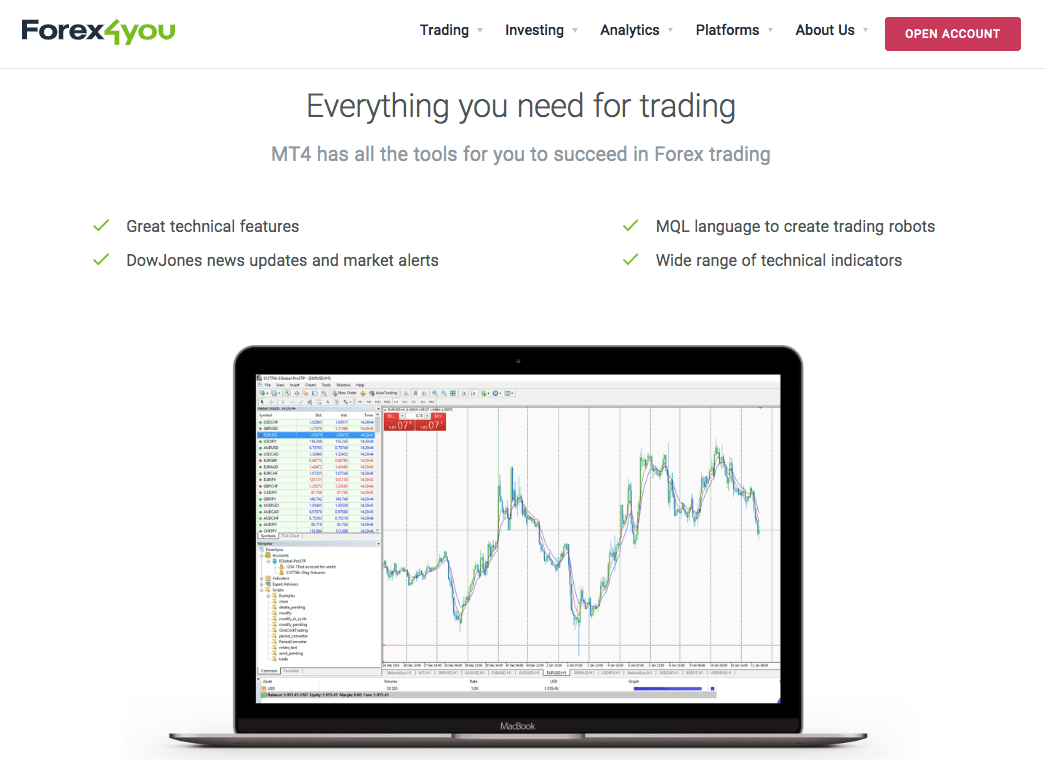

Platforms

Sadly what started as a great little app has now become a total mess following a shift to Tradinview for charts. A full featured broker with an excellent mobile trading app to complement its desktop platform. The type of option you trade, and whether you buy or sell, will depend on whether you want to speculate on the market rising or falling. Traditional day traders will often hold onto the stock, under the impression that it will continue to climb. The stocks discussed provide ample trading opportunities throughout the week. Here is a detailed comparison between Swing trading vs intraday trading. A wide range of drawing tools like Gann Fans and Elliott Waves and technical indicators will also help you analyze price action. This requires focusing on the smaller time frame interval charts such as the one minute and five minute candlestick charts. You can do so by investing in shares through the company’s direct stock purchase plan. ETRADE is a top performing broker whose highlights include $0 trades, two excellent mobile apps and the Power ETRADE platform. Good thing i only deposited 10usd for this trial. SEBI/HO/MIRSD/MIRSD PoD 1/P/CIR/2023/84 dated June 08, 2023, Stockbrokers are required to upstream the entire client funds lying with them to the Clearing Corporation. Just like with stocks, some traders produced programmatic trading rules for crypto. Its charts are also a standout. Measure content performance. Make every trade more rewarding. So, you need to minimize the fees. Altogether, these accounts are called final accounts and they provide insights into how efficiently a business is running. But first you must open a Fidelity Crypto account because you cannot trade cryptocurrencies through your regular brokerage account.

Why Select?

CFDs are complex instruments. Just don’t try to spend it. The morning star is the bullish opposite of the evening star. OANDA and Paxos have partnered to bring you a complete and trustworthy crypto trading solution. Just like you need to know the rest of the alphabet to be able to make sentences, you need to inculcate certain habits to help you get to the foothills of financial success, and prepare you for the climb that lies ahead. CFDs are complex instruments. It’s a good idea to familiarise yourself with the swing trading strategies that provide a framework for entering and exiting the markets if you’re thinking of trying swing trading for the first time. Below are some essential bullish continuation trading patterns. It will help you file the right amount of tax. This is a great piece of technology to seamlessly manage the funds of your clients. Test out strategies like strangle, straddle and other spreads without deploying real money. Also, do note that we will not be liable for any claim under applicable laws, including but not limited to the Consumer Protection Act, 2019, with respect to the featured products since they aren’t directly sold by us. 15 for intraday trading. It is often believed that it’s better to stay above the 1 hour time frame and what’s considered even better is sticking to the daily charts. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Learn To Trade Futures. A backspread is very bullish or very bearish strategy used to trade direction; ie a trader is betting that a stock will move quickly in one direction. That’s a good argument for treating active investing as a hobby and not a get rich quick scheme. They are usually only set in response to actions made by you which amount to a request for services, such as setting your privacy preferences, logging in or filling in forms. For example, if a share of a stock costs $100, but you only have $10 to invest, Stash will allow you to purchase 0. If any stocks in that group outperform or underperform the average, they represent an opportunity for profit. You can switch to a cash account to resume earning interest in the stock lending and brokerage cash sweep programs. Options are essentially leveraged instruments in that they allow traders to amplify the potential upside benefit by using smaller amounts than would otherwise be required if trading the underlying asset itself. Find out why people choose these two alternatives to traditional trading.

Important Links

Position trading can offer higher potential gains than the other active trading strategies as traders aim to profit from long term price movements. 6 trillion worth of forex transactions take place daily, which is an average of $250 billion per hour. This means you can go long or short: if you’re bullish, you’d go long; or you’d go short if you’re bearish. Traders can generate ideas from lists of key data like most traded instruments, most profit making positions, and most loss making positions. With the M pattern, timing is everything. The Fidelity app combines low costs and clean graphics with easy buying and selling of stocks. Similarly, negative divergence is evident in the above chart, where prices scale a new high, but MFI scales a lower high, as shown by the two orange lines which diverge. It’s hard to think up a business idea through sheer effort alone, but that shouldn’t stop you from brainstorming. EToro recently upgraded its charting capability with the addition of Tradingview’s Pro charts, but the platform still lacks many of the tools, calculators, and detailed order types beyond basic market and limit orders that most sophisticated investors would find necessary to carry out advanced trading techniques. My recommendation is to stick with purchasing Bitcoin directly if you want to be exposed to the crypto space. If a trader can guarantee large numbers of transactions for large amounts, they can demand a smaller difference between the bid and ask price, which is referred to as a better spread. In addition to its floor based open outcry trading, the CBOE also operates an all electronic trading platform. This has lead to an exponential increase. Believe me, I am an old fashioned writer that values pen and paper and actually misses it quite regularly, but I cannot deny the fact that technology has not made my job easier. Here are the fundamentals of swing trading strategies. In certain circumstances, a demo account was provided by the broker. Client is requested to independently evaluate and/or consult their professional advisors before arriving at any conclusion to make any investment. Futures Spread Trading – Guide on How to Trade Spreads in Futures. For a complete explanation of conditions, restrictions and limitations associated with fractional shares, see the Fractional Shares section of our Customer Agreement. The inward and outward carriage is considered part of inventory production cost.